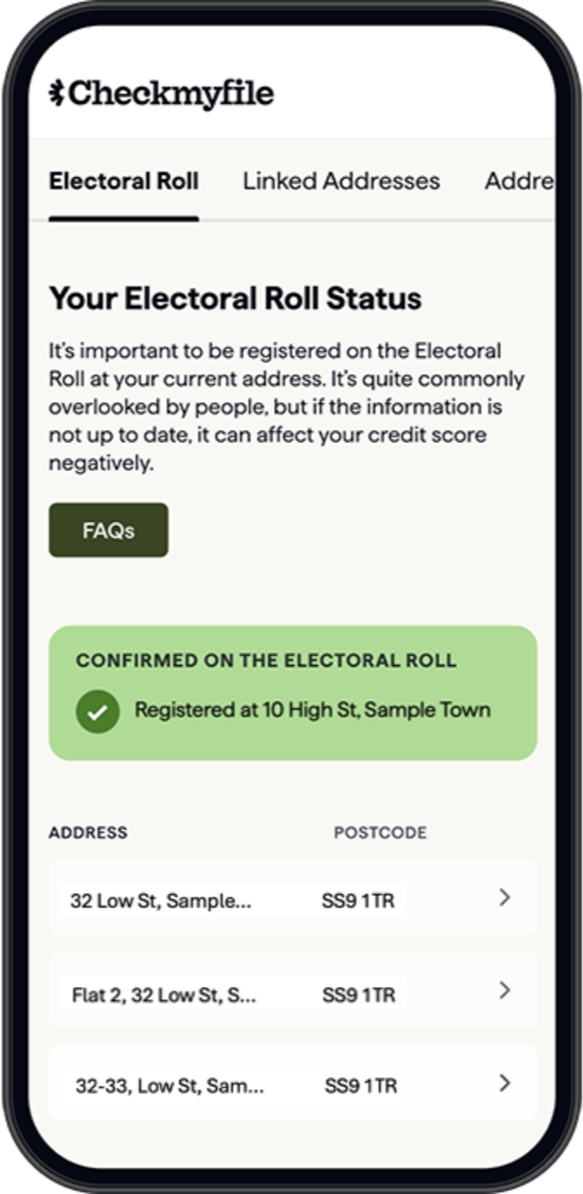

See where you’ve been

Get up to six years of credit history from Experian, Equifax and TransUnion broken down into one manageable format

Get up to six years of credit history from Experian, Equifax and TransUnion broken down into one manageable format

Let us help you correct any errors and look into any problems affecting your credit score

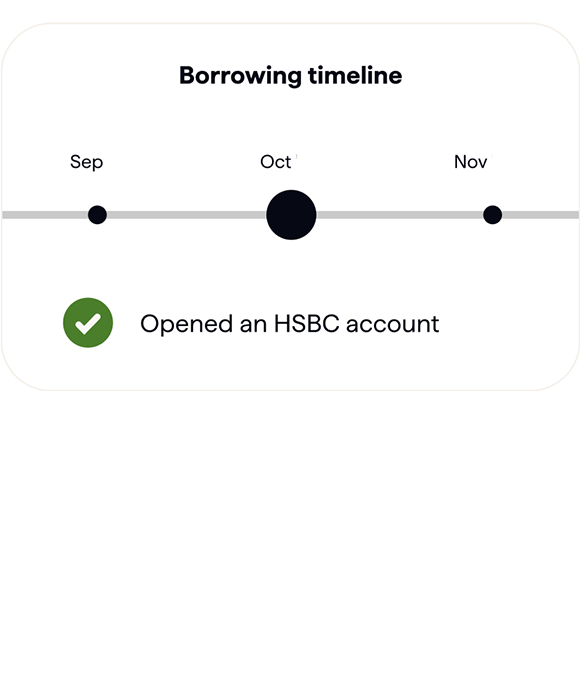

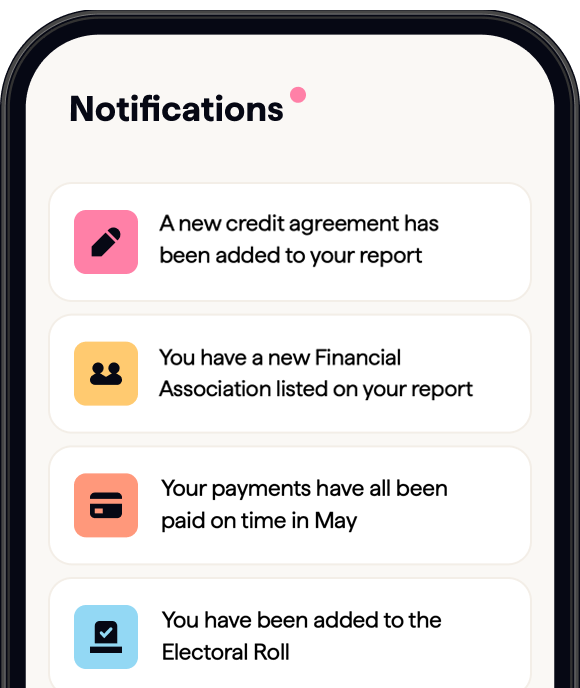

Keep up to date with your spending and borrowing habits across all of your key credit accounts

We show you how each factor in your file affects your score, helping you connect the dots and plan for the future

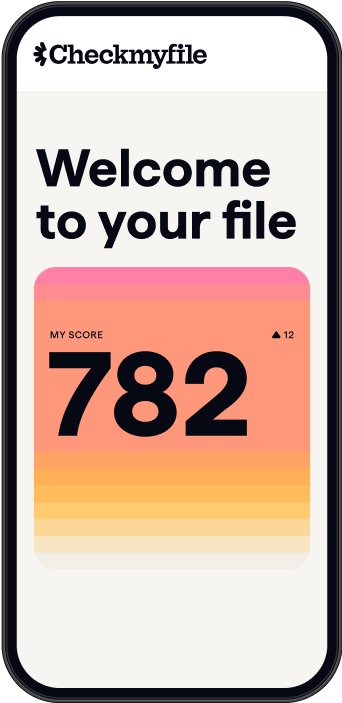

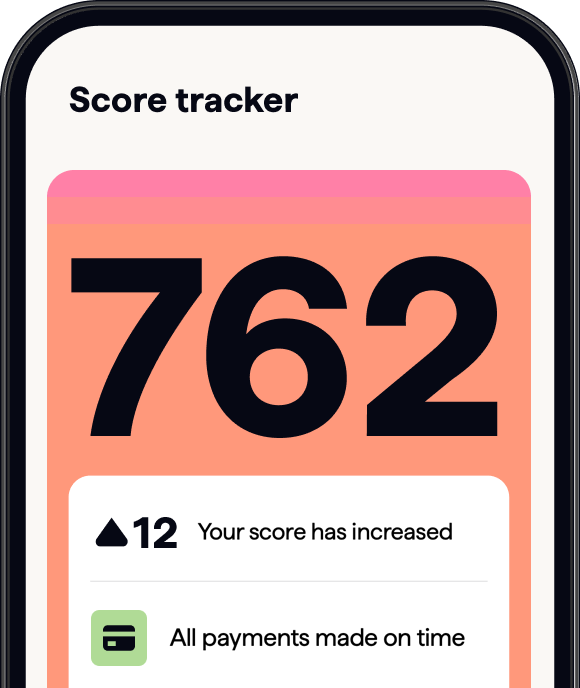

We’ll help you identify actions to help you raise your score, and celebrate the little wins along the way

Once your score is on the up, we arm you with the know-how you need to keep it rising

Every time you update your Checkmyfile credit report throughout December, you’ll earn an entry into our prize draw.

One lucky winner will receive £2,500 towards their bills - whether that’s your rent, mortgage, or credit card payments. Read more

We don’t just stick to the shadows. With your subscription, if you ever need a hand, we’re here to help. We’ll make what once felt ambitious feel way more achievable.