When do you start paying stamp duty?

Learn all about the different stamp duty rules in the UK, along with exceptions that may apply to you.

Paying stamp duty is part of the property-buying experience, but determining how much to pay and when can be confusing. Even the name changes depending on where your property is.

It’s worth noting that standard stamp duty rates are only for residential properties; different tiers apply for non-residential purchases. A separate surcharge applies on top of the default rate if you’re buying a second home or additional property. And in some cases, first-time buyers may even get stamp duty relief.

There’s a lot of information to unpack regarding paying stamp duty, so we’ll discuss the different thresholds for each nation. We’ll even talk about certain situations that might affect the amount of stamp duty you must pay.

What are the different names stamp duty has?

“Stamp duty” is the general term for the tax you must pay when buying a property in the UK. England (with Northern Ireland), Scotland, and Wales have different names and thresholds for stamp duty, but they all have the same purpose: to collect tax on your property purchase.

Here’s a quick glance at the standard stamp duty rates and their official names:

In England and Northern Ireland, it’s called Stamp Duty Land Tax

No SDLT on residential properties worth £250,000 or less

For first-time buyers, there’s no stamp duty on the first £425,000 of residential properties worth £625,000 or less

Payable within 14 days from the date of completion

In Scotland, it’s called Land and Buildings Transaction Tax

No LBTT on residential properties worth £145,000 or less

No LBTT for first-time buyers buying a property worth £175,000 or less

Payable within 30 days from the date of completion

In Wales, it’s called Land Transaction Tax

No LTT on residential properties worth £225,000 or less

No LTT relief for first-time buyers

Payable within 30 days from the date of completion

How much stamp duty do I need to pay?

How much stamp duty you need to pay depends on several factors, such as:

If you’re a first-time buyer

If you’ve ever owned a property in the UK or anywhere in the world

If the property is for residential or non-residential use

The value of the property

The property’s location

Calculating your stamp duty rate (regardless of your property’s location) considers the entire property price and how it fits into every tier. You will be charged on every applicable price threshold.

For example, if you bought a house in England worth £675,000, here’s how your stamp duty may be calculated:

0% on the first £250,000 = £0

5% on the remaining £425,000 = £21,250

That means you pay £21,250 in Stamp Duty Land Tax. If the property is in Wales or Scotland, the calculation process is similar but with different thresholds and percentages.

England (with Northern Ireland), Wales, and Scotland have their own rates and rules, so let’s look at each one in detail.

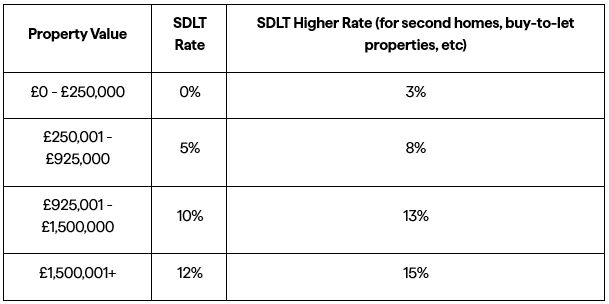

England and Northern Ireland SDLT Rates for Residential Properties

If you’re a first-time buyer: You don’t pay any SDLT on the first £425,000 of your purchase price. You pay the regular rate on the remaining value of the property.

To be considered a first-time buyer, you must not have previously owned any property (freehold or leasehold) in the UK or abroad. This distinction includes any properties you may have inherited, even if you sold them immediately.

If you’re purchasing a residential leasehold: Your SDLT rates are based on your lease premium. However, specific rules apply if you have an assigned lease or pay more than the nominal rent. HM Revenue & Customs has published guidance for SDLT on leasehold properties.

If you’re not a UK resident: Non-UK residents must pay a 2% surcharge on top of the base rate. You’re considered a non-UK resident if you’re not in the UK for at least 183 days during the 12 months prior to your property purchase. Refer to the SDLT guidance for non-residents for more details.

If you sold your previous home shortly after buying a second property: You can apply for a refund of the higher SDLT rate if you sold your first home within 36 months after purchasing a second property. HMRC has specific guidance on eligibility and how to apply for a refund.

If you’re buying a non-residential property: HMRC has specific rate tables for freehold and leasehold sales of non-residential properties. The page also defines which properties are considered non-residential.

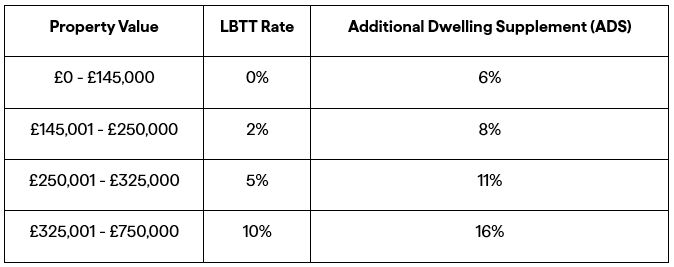

Scotland LBTT Rates for Residential Properties

If you’re a first-time buyer: You don’t pay any LBTT on the first £175,000 of your purchase price.

If you have to pay the Additional Dwelling Supplement (ADS): Revenue Scotland details several situations where ADS is applicable and how to claim a refund if you’re eligible.

If the property is non-residential: Revenue Scotland has specific guidance for non-residential properties, depending on if the transaction is a sale or a lease. The page also describes which properties are considered non-residential.

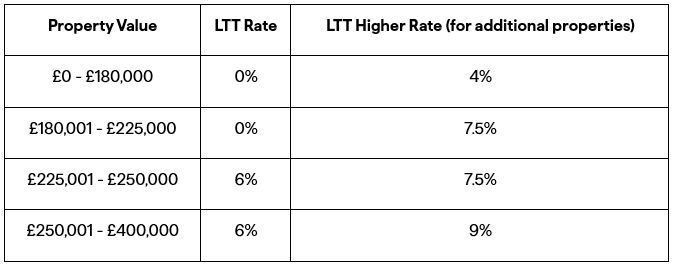

Wales LTT Rates for Residential Properties

If you’re a first-time buyer: Wales doesn’t have first-time buyer relief.

If you have to pay the LTT Higher Rate: The Welsh Revenue Authority has specific details on when the LTT Higher Rate is applicable, how to claim a refund (if eligible), and any exceptions.

If the property is non-residential: Wales has specific LTT rate tables for buying or renting non-residential properties.

Your solicitor, conveyancer, or agent will typically file the return online and pay the stamp duty on your behalf. They can also give you specific stamp duty advice if your situation isn’t straightforward, such as if you’re purchasing a buy-to-let property or you’re a non-UK resident.

If you don’t have a solicitor or conveyancer representing you, you can pay for your stamp duty by filing a paper return.

When do I need to pay stamp duty?

Your stamp duty payment deadline depends on your completion date and the property’s location. The completion date is when you and the seller have exchanged contracts and completed all checks, and your solicitor has transferred the money to the seller’s solicitor. In other words, when you’re ready to pick up the keys to your new home.

In England and Northern Ireland, your SDLT return must be filed and paid within 14 days of completion. For properties in Scotland and Wales, you (or your solicitor) have 30 days to do so.

Failure to file and pay stamp duty within the timeframe will result in separate penalties: one for late filing and another for late payment. It’s also worth noting that a late stamp duty payment incurs daily interest charges on top of any tax and penalty charges due.

Each government website will have more details about the penalty fees and how to appeal them:

HMRC for England and Northern Ireland

What if I don’t need to pay any stamp duty?

Even if your property’s purchase price falls within the 0% stamp duty rate (also known as the “nil rate band”), you still need to file a stamp duty tax return within the specified timeframe.

However, some transactions are exempt and don’t require filing a stamp duty return. HMRC, Revenue Scotland, and the Welsh Revenue Authority have specific lists of exempted transactions.

What if I don’t pay my stamp duty?

Not paying any stamp duty you owe will result in penalties and daily interest charges. The longer you don’t pay, the more you’ll owe.

If you hire a solicitor to represent you during the buying process, they’ll typically handle any stamp duty obligations on your behalf. Otherwise, you’ll have to file a paper tax return and use a stamp duty calculator to calculate how much tax you need to pay.

Remember: You have 14 days after your completion date to pay any stamp duty you owe in England and Northern Ireland. In Wales and Scotland, you have 30 days.

How do I pay for stamp duty?

If you hire a solicitor or conveyancer to represent you, they can file and pay for your stamp duty online.

However, you can’t use the online service if you file the stamp duty return yourself. You’ll have to use a stamp duty calculator to determine how much tax you owe, request a paper form, and send your stamp duty tax return by post. Here’s how:

England and Northern Ireland: Order SDLT return forms online or by ringing 0300 200 3511

Scotland: Send an email to lbtt@revenue.scot to request a paper form

Wales: Complete the online contact form or ring 03000 254 000

Once you send your paper return, you have a couple of options for paying your stamp duty:

Bank Transfer (Faster Payments, CHAPS, or BAC)

Cheque (England and Northern Ireland only)

HMRC, Revenue Scotland, and the Welsh Revenue Authority pages have the account details and other relevant instructions when paying by bank transfer.

Can I add my stamp duty costs to my mortgage?

Most mortgage lenders will allow you to add stamp duty costs to your mortgage, but it affects your loan-to-value (LTV) ratio. It can also increase how much you borrow, meaning higher monthly payments.

LTV is the percentage of how much you need to borrow compared to your property’s value. Typically you need a 10% deposit to purchase a house, this would make your LTV 90%.

Some mortgage lenders have a maximum LTV they’re willing to lend, so adding stamp duty to your loan could push you beyond that limit. Higher LTVs also have higher interest rates because they’re considered higher-risk loans.

For specific mortgage advice, we recommend you talk to a mortgage broker.

Does paying stamp duty impact my credit score?

Paying stamp duty for your new property is a legal obligation, not a credit agreement with a lender, so it doesn’t affect your credit score.

However, if you choose to add your stamp duty costs to your mortgage this could affect your credit score if it makes your monthly repayments unaffordable. Your credit report will show whether you’re currently making (or missing) your monthly mortgage payments, which has a direct impact on your credit score.

Keep in mind that adding stamp duty costs to your mortgage will likely result in higher monthly payments. So it’s best to speak with your mortgage broker before pursuing this option.

It’s always good to check your credit report before applying for a mortgage to get yourself application ready! Register with Checkmyfile now and see the most detailed UK credit report you can get, with data from all three main credit reference agencies - Experian, Equifax and TransUnion.

How do I get more information about paying for stamp duty?

If your circumstances are unusual or you’re unsure how to proceed with your stamp duty, it’s best to consult a solicitor (if you don’t already have one). They can help you determine how much tax to pay and navigate stamp duty rules to ensure you’re compliant with the government.

You may find general guidance for your query on each government’s stamp duty website or through their contact channels:

England and Northern Ireland

Scotland

Send an email to lbtt@revenue.scot for all LBTT-related questions

Wales

Recap: When do you start paying stamp duty?

There’s a lot of information to consider when paying stamp duty, so let’s recap the basics.

When buying one property that will be used as your main home, you don’t pay any stamp duty above the nil rate band. That band differs depending on where your property is:

For England and Northern Ireland, that’s £250,000 or less.

In Scotland, it’s £145,000

In Wales, it’s £225,000

Anything above those prices will start incurring stamp duty.

If you’re searching for your first home and haven’t owned any property before, you can take advantage of first-time buyer relief schemes in England, Northern Ireland, and Scotland. Wales doesn’t have such a programme in place.

Certain situations trigger different rates, so check each government’s stamp duty website for guidance or ask a solicitor for advice.